Silver Supply and Demand – 2015.

Silver in supply deficit for third year in a row as demand outstrips supply.

Silver prices fall for third year in a row.

Silver coin and bar demand surges 324% from 2006 to 2015.

Industrial silver demand falls from 70% of overall demand in 2006 to 54% in 2015, while overall silver demand climbs 13% during the same period.

India projected to import 29-33% of total 2015 silver mining production this year.

The Silver Institute slashes the projected amount of silver required for solar energy from over 100 million ounces in 2015 to 74 million ounces, with a projection for under 70 million ounces required in 2016.

How to Buy Silver

Demand for silver is outpacing supply again – yet the price of silver continues to fall.

Do the dynamics of supply and demand matter any more?

In September 2013 we asked – Is a Gold and Silver Supply and Demand Price Adjustment Coming? In that blog post we noted the increasing silver demand and decreasing silver price.

2013 was a record year for American Silver Eagles sales, and a record year for over all silver demand.

In October 2014, we issued a comprehensive survey of silver supply and demand. In that report we showed that demand for silver continued to increase and outpace silver supply. Sales of American Silver Eagles in 2014 again hit a record surpassing 2013’s sales totals.

In November 2015, the Silver Institute reported, silver demand out stripped supply for the third consecutive year.

If silver demand from ETFs and derivative exchange inventories is included in the demand equation, silver demand has outstripped supply for the past twelve years.

A primary source of the physical silver deficit the past few years has been the strong demand for silver coins and bars.

Silver: An Industrial Metal?

As recently as 2006, silver was primarily an industrial metal with 70% of silver demand consumed by various industries. In 2015, due to a 324% increase in silver demand for coins and bars, industrial demand has been reduced to just over half of over overall silver demand.

For futher analysis of silver demand by sector see below Appendix I: Silver an Industrial Metal Revisited

Sign Up For Smaulgld.com Updates Here!

Silver Demand By Uses 1994-2015 – The Silver Institute

Silver Coin Demand Surges in 2015

According to the Silver Institute, silver coin demand is forecast to increase nearly 21% in 2015 to total a record high of 129.9 million ounces. This would constitute 12% of overall silver demand, up from 4% in 2005.

“Coins” are defined as silver products issued by government mint and do not include privately minted rounds and bars. When privately minted silver products are included with silver coins they constitute nearly 20% of overall silver demand.

Silver coin and bar sales are projected to constitute 19.5% of overall silver demand in 2015. We believe that the Silver Institute correctly projected silver coin demand for 2015 (129.9 million ounces), but significantly underestimated demand for privately minted silver rounds and bars.

Click here for a discussion of silver coin, bar and round demand in 2015.

Here is our, perhaps aggressive, projected sales of silver coins (in ounces) from the major sovereign mints in 2015.

Estimates include all types and sizes of silver coins produced by the mints and silver bars, where applicable.

Sign Up For Smaulgld.com Updates Here!

United States Mint

American Silver Eagles

The United States Mint produces the American Silver Eagle one ounce coin from mints in Philadelphia, Denver and San Francisco. The American Silver Eagle is by far the most recognized government produced silver coin and has sold over 444 million since production began in 1986 through 2015.

Last year a record 44 million American Silver Eagles were sold by the United States Mint. This year, the United States Mint is expected to sell as many American Silver Eagles or more.

Through November 20, 2015, the U.S. Mint has sold 42,929,500 American Silver Eagles.

You can track monthly sales of American Silver Eagle coins at our American Silver Eagle archives.

Even though sales of American Silver Eagle coins appear to be headed towards a record in 2015, sales were limited due to suspension by the U.S. mint of production of these coins for a few weeks due to a shortage of silver blanks and restrictive allocations to the U.S. Mint’s Authorized Purchasers.

Due to the U.S. Mint’s inability to keep up with demand for American Silver Eagle coins, premiums doubled during the month of September, further curbing sales.

This chart and charts showing the premiums of other popular silver and gold coin premiums is updated here from time to time.

Compare American Silver Eagles for sale at:

Golden Eagle Coins

SD Bullion

Money Metals Exchange

America the Beautiful Coins

In addition to the American Silver Eagle one ounce coins, the U.S. Mint also produces America The Beautiful coins in five ounce sizes that depict various United States National Parks.

Sales do not include the final coin of the 2015 America the Beautiful series, the Saratoga National Historical Park coin.

Canadian Mint

The Royal Canadian Mint (RCM) produces a variety of silver Maple Leaf coins. The Canadian Silver Maple Leaf coin was introduced by the RCM in 1988 for collectors.

The Royal Canadian Mint has sold over 150 million Silver Maple Leaf coins since 1988 when it was first minted and sold a record 28 million in 2013. This record was broken in 2014 when 29.2 million ounces were sold and through the first half of 2015, sales of silver at the Canadian Mint were on pace to set another record.

The RCM also produces special issues of the Silver Maple Leaf coin from time to time. Past special issues include Olympic, Anniversary, Wildlife, Chinese Zodiac, Birds of Prey and Canadian Artic coins.

Compare Canadian Silver Maple Leaf coins for sale at these online bullion dealers:

You can track Canadian Mint quarterly and annual sales of silver at our Canadian Mint sales archives.

Perth Mint

The Perth Mint, founded in 1899 as a branch of the British Royal Mint, produces a wide variety of silver and gold coins usually featuring Australian wildlife (e.g. Crocodiles, Koalas, Kangaroos and Kookaburras). Silver sales at the Perth Mint have grown steadily the past few years and exploded in 2015 with the introduction of their silver Kangaroo coin.

The Perth Mint sold over 8.6 million ounces of silver in 2013 and more than 7.5 million ounces in 2014.

The introduction of the silver Kangaroo coin at the height of the Great Silver Shortage of 2015 in September turbo charged Perth Mint silver sales.

Silver sales at the Perth Mint soared 366% after the introduction of the Silver Kangaroo coin.

You can track monthly sales of Perth Mint silver at our Perth Mint sales archives.

Compare Perth Mint Silver Kangaroo coins for sale:

Sign Up For Smaulgld.com Updates Here!

Austrian Mint

The Austrian Mint, a subsidiary of the National Bank of Austria, produces the Austrian Silver Philharmonic coin which is Europe’s and Japan’s largest selling silver bullion coin with sales over 60 million from 2008-2015.

Sales of the Austrian Mint’s Vienna Philharmonic silver coin in 2015 through September 2015, are modest compared to 2011’s record year.

Compare Austrian Silver Philharmonic coins for sale at these websites:

Chinese Mint

The official mint of the People’s Republic of China has been producing Silver Panda coins since 1983.

Approximately 48 million one ounce Chinese Silver Panda coins have been sold from 1983-2015.

In the past few years, China has ramped up its annual production of one ounce Chinese Silver Pandas from 600,000 annually to 8,000,000 a year the past four years.

In 2015, the Chinese Mint is expected to sell eight million 1 ounce silver panda coins, 50,000 five ounce and 20,000 1 kg silver panda coins for a total mintage of about nine million ounces.

Starting in 2016, the Chinese silver panda coin will be minted in a slightly smaller 30g size.

Check out Chinese Silver Panda coins for sale at:

The British Royal Mint

The Royal Mint was established in 1968 and is located in Llantrisant, South Wales. The current Royal Mint facility carries on the mint’s 1,100 year history of producing coins and replaced the facilities operated at Tower Hill, London since 1810. The Royal Mint produces coins for more than 60 countries around the world.

The Royal Mint began producing the Silver Britannia coin series in 1997 at which time the silver content was 95.8%. Since 2013, the Silver Britannia has been produced in .999 form (99.9%). The Silver Britannia has increased in popularity in recent years selling 560,000 ounces worth of them during fiscal year 2012-13 and 2,125,000 during fiscal year 2013-2014.

Official 2014-2015 or 2015-2016 annual sales have not been released publicly, but a statement from the director of bullion at the Royal Mint pegged sales 600% higher than last year.

Our estimate of 6,000,000 silver Britannia coins sold in 2015 may, therefore, be extremely conservative.

For a large selection of British Silver coins from JM Bullion, click here.

Or compare pricing and shipping on Silver Britannias at Golden Eagle Coin or at Money Metals Exchange.

Silver Industrial Demand

Silver industrial demand comes primarily from the solar, electronics, medical industries and for use in photography.

Silver For Solar Energy

According to the Silver Institute, demand for silver from the solar industry is forecast to increase to 74.2 million ounces in 2015 or about 13% of industrial silver demand and about 7% of overall silver demand.

China

Silver demand for use in the production of solar panels has been increasing at a rapid rate. A good portion of the demand comes from China.

China has invested heavily in the photovoltaic industry as it seeks to supplement its voracious energy demands and reduce its air pollution problem with solar power. China is the world’s number one consumer of energy but is second behind Germany in total solar power generation.

In addition to manufacturing solar panels for domestic use, China is the world largest manufacturer of solar panels for export.

The photovoltaic cells in solar panels use a silver based paste.

In our 2014 Silver Supply and Demand report we noted

Solar manufacturers are projecting to ship a record amount of solar panels in 2014 and the silver demand for the photovoltaic industry is expected to reach 100 million ounces in 2015.

Last year the Silver Institute cited a 100 million ounce estimate for 2015 on their solar energy page. They have revised their solar energy page to read “close to 70 million ounces of silver are projected for use by solar energy by 2016.”

Click here to see the Silver Institute’s solar energy page as it appeared on July 9, 2014, projecting over 100 million ounces required for use in the solar energy industry in 2015.

According to Reuters GFMS data, in 2005 China used less than a million silver ounces in producing solar panels compared to 38 million ounces in 2012.

In October of 2015, China upped its solar power installation target for the current year by thirty percent from its prior forecast. China projects to add another 5.3 Ggigawatts of solar energy capacity in addition to an earlier target of 17.8 gigawatts. China has a five year goal of installing 100 gigawatts of solar energy capacity by 2020.

According to Investment Research Dynamics, China will require approximately 150 million ounces of silver per year to meet its solar energy goals (far higher than the Silver Institute’s estimate of 74.2 million ounces projected to be used globally by the photovoltaics industry in 2015).

While China is the third largest silver mining country in the world, producing on average less than 120 million ounces the past few years, that amount is short of the amount of silver it needs to achieve its solar energy goals.

Nearly all of Chinese silver mining production is retained domestically. Therefore, the total global silver mining supply available for the rest of the word is not the 867.2 million ounces global supply projected by the Silver Institute, but something closer to 750 million ounces.

India

India is also a major consumer of silver for solar power. India requires over 50 million ounces of silver a year to meet its solar panel manufacuring demand. According to Scrap Monster, one mega Indian solar panel plant will require twenty million ounces of silver a year.

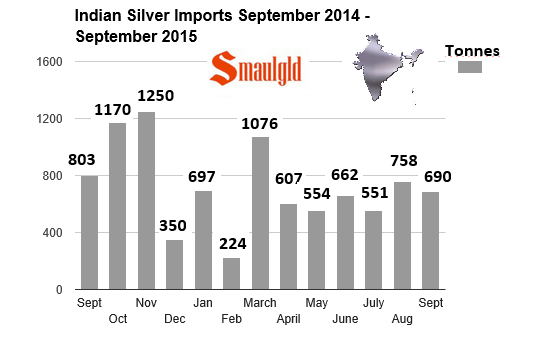

Indian Silver Imports

Indian silver imports have steadily increased. Through September 2015, India has imported 5,819 tonnes of silver or over 187 million ounces. At the present run rate, India should import a record 7700+ tonnes of silver in 2015, or nearly 250 million ounces.

According to the Silver Institute, global silver mining production is projected to be 867.2 million ounces. If India imports 250 million ounces of silver in 2015, it would account for nearly 29% of global silver mining production. If China’s silver mining production is removed from global supply, Indian silver imports would account for over 33% of available global silver mining production.

The charts below reflect Indian silver imports through September 2015. It is not certain, however, how much of it is for industrial use, silverware or investment.

To follow Indian Silver imports monthly check out our Indian Gold and Silver Import Charts.

Silver for Electronics

Silver is the best conductor of electricity. As such, it is prized for use in electronics of all sizes.

According to the Silver Institute the following amounts of silver are needed in the production of each:

-cell phone .05-.25 grams for a total of 2.6 million to 13 million ounces of silver per year; and

-PC/lap top .3-.5 grams for a total of 3.5-5.8 million ounces of silver per year

Silver used in the production cell phones and computers and all other types of electronics adds up to over 200 million ounces each year.

Silver For Anti-Microbial and Medical Uses

Medical Devices/Anti-Microbial Products/Water Filters/Gorilla Glass

Silver has been found to have anti-microbial properties and its demand for use in products such as medical devices, water filters, Extra Strength Colloidal Silver Soap and oinments, while still small, has grown quickly in recent years.

Silver for Ethylene Oxide

Silver is used in the production of ethylene oxide which is used as a fumigant in agricultural products, a sterilant in medical products and in various detergents, thickeners, solvents and plastics.

The Silver Institute projects that demand from ethylene oxide producers will increase 49% to eight million ounces in 2015.

Silver For Photography

Photography was once one of the major uses for silver but since the advent of digital photography in the late 1990’s/early 2000’s, the demand for silver for photography has subsided.

Silver Demand for Jewelry/Silverware

Silver has been prized for its beauty for thousands of years and demand for jewlery and silverware provides about 25% of the overall silver demand each year.

Silver Held in ETFs

The Silver Institute does not count silver held in exchange traded funds (ETFs) in its silver supply/demand calculation. Rather, the Silver Institute reports silver ETF build of inventory as a seperate line below their supply and demand calculation.

The addition of silver to ETF’s in prior years resulted in the Silver Institute’s below the line supply/demand calculation to be in persistent large deficits even if their above the line supply/demand calculation showed a surplus. For example, in 2010 the Silver Institute showed an above the line surplus of silver of about 52 million ounces, but after giving effect to about 130 million ounces added to ETFs that year, the below the line supply demand calculation showed a deficit of 84 million ounces.

In 2015, however, there are projected to be net withdrawals from silver ETFs. The Silver Institute reported that these withdrawals from silver ETFs acted to “lessen the impact of the physical deficit.” Withdrawals from ETF acted as adding to supply to help allieviate the physical silver deficit by 21.4 million ounces from 42.7 million ounces 21.3 million ounces. In prior years, as silver ETFs added silver, the deficits were much larger.

We believe that silver that flows into ETFs constitutes silver demand. When silver ETF demand is included in the supply demand calculation there has been a deficit every year since 2004.

The chart below shows the explosive growth in silver held in ETFs. The largest silver ETF, iShares Silver Trust (SLV) for which JPMorgan acts as custodian, holds over 300 million ounces of silver.

Silver Holdings in ETFs 2006-2015

The chart above doesn’t include silver held in closed-end fund the Central Fund of Canada (CEF), digital gold services like Gold Money and Bullion Vault, or silver held in the Perth Mint certificate or Canadian Mint storage programs. Those holdings are included in this chart:

Silver Held in Custody By ETFs and Other Silver Storage Providers

Silver held in custody by ETFs, closed end funds, digital silver companies like Gold Money and Bullion Vault, in silver certificate programs like the Perth Mint’s and in storage by the Canadian Mint have reached over 850 billion ounces.

Comex Silver Inventory

The Silver Institute also does not count silver that is added to or withdrawn from COMEX vaults in its above the line calculation of silver supply and demand.

Thus, the increase in investor silver demand as reflected in the stockpiling of silver in COMEX eligible warehouses is NOT considered part of silver demand by the Silver Institute.

Silver Supply and Demand Surplus/Deficit

Silver Supply and Demand Surplus/Deficit 1994-2015 – The Silver Institute

Factors Impacting Silver’s Supply Deficit

The Low Price of Commodities and Silver

According to the Silver Institute, silver mining production will reach a record in 2015. We expect silver production to decline in the coming years and for demand to continue to increase.

Silver Mining Prodution as a by Product of Other Mining Activities

About 70% of silver mining production is derived as a by product of the mining of other industrial metals like copper, lead and zinc. Due to a global economic slow down resulting in lower demand and prices of industrial metals, many mines will be forced to cut back or cease production, resulting in lower silver output.

Miners won’t mine or won’t sell what they mine

Because of the low price of silver, primary silver miners will also either cease mining operations or not sell what they mine. In a move, not followed by the rest of the mining industry, primary silver miner First Majestic Silver Corp withheld part of it silver production from the market last year.

First Majestic Silver Corp. To Withhold One Million Ounces of Production From the Market

First Majestic Silver Corp, one of Mexico’s largest silver producers announced last year its decision not to sell nearly 1 million ounces of silver.

From the First Majestic Press Release:

“Produces 3.5 Million Silver Eqv. Ounces in Q3; Postpones the Sale of 934K Silver Ounces of Inventory

Press Release: – Tue, 14 Oct, 2014 7:00 AM EDTSilver prices declined 19% in the third quarter representing the second largest quarterly decline since the financial crisis in 2008. As a result of this weakness, the Company decided to temporarily suspend silver sales in an attempt to maximize future profits. This suspension of sales will result in lower revenues and earnings for the third quarter, however, it is likely that these inventories of unsold ounces will instead be sold in the fourth quarter. As of September 30, 2014, approximately 934,000 ounces of silver were held in inventory.”

If prices continue to fall, we may expect to see a revival of this tactic by First Majestic and perhaps other primary silver miners.

Mexican Mining Tax

If a declining silver price wasn’t enough to discourage miners from continuing operations and exploration, Mexico the world’s leading silver producer, instituted a new mining tax in 2014. While the tax is facing legal challenges and lobbying efforts, an uncertain and potentially adverse outcome is not condusive to further investment in Mexico.

Scrap Supply Decline

Acccording to the Silver Institute secondary silver supply from scrap will decline 5% in 2015. Lower silver prices are not inducive for holders of silver to sell, thus reducing the amount of recyclable silver on the market.

China Hoards Silver Production

China is now the worlds largest gold producer and gold importer as well as the world’s third’s largest silver producer, behind Mexico and Peru. While China is a large producer of silver, it consumes domestically nearly all of the silver it produces, leaving little, if any, available for export.

Increase in Silver Coin Sales

The Silver Intitute remarked on the record silver coin sales in 2015 “This largely unexpected surge resulted in an unprecedented shortage of current year silver bullion coins among the world’s largest sovereign mints.”

We expect that continued global financial uncertainty, coupled with low silver prices, will most likely ensure demand for silver coins and bars to remain elevated.

In recent years demand for silver coins and bars have gone from a negligible amount of about 5% to about 20% of the annual silver demand. Generally, once silver coins are minted they are not melted back down. Thus, silver coins (and to a greater or lesser extent jewelry and silverware) once minted or crafted do not return to the supply of silver.

As silver mining production falls, and silver coin and bar demand grows, we expect such demand to top 25% of overall demand over the next three years.

Silver Used In Electronics, Mirrors and CDS/DVDs is Consumed and Not Recovered

Because of silver’s low price, much of the silver in used electronics and solar panels gets tossed and is not recovered or recycled. Silver is essentially consumed in electronics, CD’s, DVDS, mirrors and solar panels.

With low prices depressing scrap and mining supply we expect supply to fall and demand for silver coins and bars, solar energy to increase, leading to another supply demand deficit in 2016.

What’s Next For Silver?

Silver is in perpetual supply deficit.

The Silver Institute noted in its recent report “While such deficits do not necessarily influence prices in the near term, multiple years of annual deficits can begin to apply upward pressure to prices in subsequent periods.”

Will ordinary market forces of supply and demand eventually overwhelm what appears to be manipulation?

An Entire Year’s Global Silver Production is Worth Just $14 Billion

The silver market is so small that one extremely wealthy person could buy an entire years’ global mining production worth of silver. In 2014, the total silver mined world wide was 865 million ounces. At a price of $15 an ounce that is only approximately $12.9 billion!

In a such small market anything can happen quickly.

Will growing demand for physical silver and lower supply relative to that demand eventually manifest itself in higher prices?

Please consider making a small donation to Smaulgld.com. Thanks!

If you have enjoyed this report, please consider buying your precious metals through the Smaulgld affiliates linked to on this site* and subscribing (for free) to Smaulgld.com.

Get Free Updates From Smaulgld.com

Subscribe to Smaulgld.com to receive free gold and silver updates, news and analysis.

Appendix I: Silver and Industrial Metal Revisited

If the Silver Institute underestimated 2015 privately minted silver round and bar demand, as we argue they did here, silver coin and bar demand would rise from a projected 206.5 million ounces to 246.7 million ounces and over all demand would rise from a projected 1,057.1 million ounces to 1097.3 million ounces.

Assuming no further adjustments, this would lift the silver coin and bar demand to 22.5% and reduce industrial demand to 52%.

This chart is amended to assume that if silver coin demand grew by 21% in 2015, silver round and bar demand also grew by the same amount vs. the Silver Institute’s projection that silver round and bar demand declined by 21% in 2015.

If annual demand for silver for ETFs and silver added to derivative exchanges like Comex were included in overall silver demand, the percentage of silver earmarked for industrial demand would fall well below 50%.

Credits: Shanghai solar panels photo-Canstockphoto

Further Reading:

12 Ways Silver is Different Than Gold

Homes Priced in Ouces of Silver

Gold and Silver Manipulation – Suspected

Silver and Gold Manipulation – Actual

Price of Silver in 1979/80 vs 2013/14

The U.S. Mint used 550 Ounces of Silver to Mint 1964 Coins

Please visit the Smaulgld Store for a larger selection of recommended Kindles, books, music, movies and other items.

Or you can support Smaulgld.com by making all your Amazon purchases through the search widget below and by ordering your gold and silver by clicking on the SD Bullion, Golden Eagle Coin, Perth and Royal Canadian Mint ads on the site.

*DISCLOSURE: Smaulgld provides the content on this site free of charge. If you purchase items though the links on this site, Smaulgld LLC. will be paid a commission. The prices charged are the same as they would be if you were to visit the sites directly. Please do your own research regarding the suitability of making purchases from the merchants featured on this site.

Chart Disclaimer: Information presented here has been obtained from a third party and is presented for information purposes only. Smaulgld can not and does not guarantee the accuracy or timeliness of the data displayed on this site and therefor the data provided should not be used to make actual investment decisions. You should always consult a professional investment adviser before investing in precious metals or any type of investment. You acknowledge that Smaulgld assumes no responsibility for the integrity of data on this site.

The content provided here is for informational purposes only. Making investment decisions based on information published by Smaulgld (SG), or any Internet site, is not a good idea. Accordingly, users agree to hold SG, its owner and affiliates, harmless for all information presented on the site. SG presents no warranties. SG is not responsible for any loss of data, financial loss, interruption in services, claims of libel, damages or loss from the use or inability to access SG, any linked content, or the reliance on any information on the site.

The information contained herein does not constitute legal, tax or investment advice and may be subject to correction, completion and amendment without notice. SG assumes no duty to make any such corrections or updates. As with all investments, there are associated risks and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal and tax advisers to evaluate independently the risks, consequences and suitability of that investment. SG disclaims any and all liability relating to any investor reliance on the accuracy of the information contained herein or relating to any omissions or errors and as such disclaims any and all losses that may result.

Send Litecoin to this address:

Send Litecoin to this address: